New York State And City Income Tax 2024 2025

Exemption from new york state and new york city withholding. New york city residents must pay a personal income tax, which is administered and collected by the new york state department of taxation and finance. To claim exemption from new york state and city withholding taxes, you must certify the following conditions in writing:

How Much Is Property Tax In New York City

You did not have a new york income tax liability for the previous year; The rules regarding new york city domicile are also the same as for new york state domicile. New york state income tax rates range from 4% to 8.82%, depending on your income and filing status.

If you live in new york city, you’ll be required to pay even more tax, as the city imposes its own local income tax system on top of the state’s.

You want to claim a refund of any new york state, new york city, or yonkers income taxes withheld from your pay or from your unemployment insurance benefit payments. You want to claim any refundable or carryover credits. Like the federal income tax, the new york city income tax is progressive, meaning the rate of taxation increases as taxable income increases. Being the fourth most populous us state, new york has a population of over 20 million (2021).it is known for its diverse geography, melting pot culture, and the largest city in america, new york city.

In addition to new york state income tax, residents of new york city are also subject to additional income taxes. For the 2024 tax year (filed in 2025), new york city has four tax brackets for the 2024 tax year, ranging from 3.078% to 3.876%. Find out how much you'll pay in new york state income taxes given your annual income. Customize using your filing status, deductions, exemptions and more.

New york city (nyc) income taxes and new york state (nys) income taxes are distinct, and understanding the differences is essential for accurate tax compliance.

While both taxes are levied on income, they apply to different groups and follow separate rules. Were a new york city or yonkers resident for the tax year, and; Are required to file a new york state income tax return. *new york city includes the bronx, brooklyn, manhattan, queens and

New york state has nine income tax rates, ranging from 4% to 10.9%. Tax credits and deductions, filing status and residency status can influence what you pay. This guide walks you through everything you need to know about new york’s income taxes, including special situations like city tax, tax brackets, deductions, and filing tips for the 2024 tax year in the empire state. New york city levies personal income tax on people, trusts and estates if their income is earned in the city.

The city also imposes a number of taxes on businesses and corporations that operate within its limits.

Information about tax rates and tax tables for new york state, new york city, yonkers and the metropolitan commuter transportation mobility tax by year are provided below. All city residents’ income, no matter where it is earned, is subject to new york city personal income tax. Nonresidents of new york city are not liable for new york city personal income tax. The rules regarding new york city domicile are also the same as for new york state domicile.

View the information on where to find the tax rates and tables for: New york state, new york city, yonkers, and; The metropolitan commuter transportation mobility tax (mctmt). Overview of new york taxes.

New york state has a progressive income tax system with rates ranging from 4% to 10.9% depending on a taxpayer's income level and filing status.

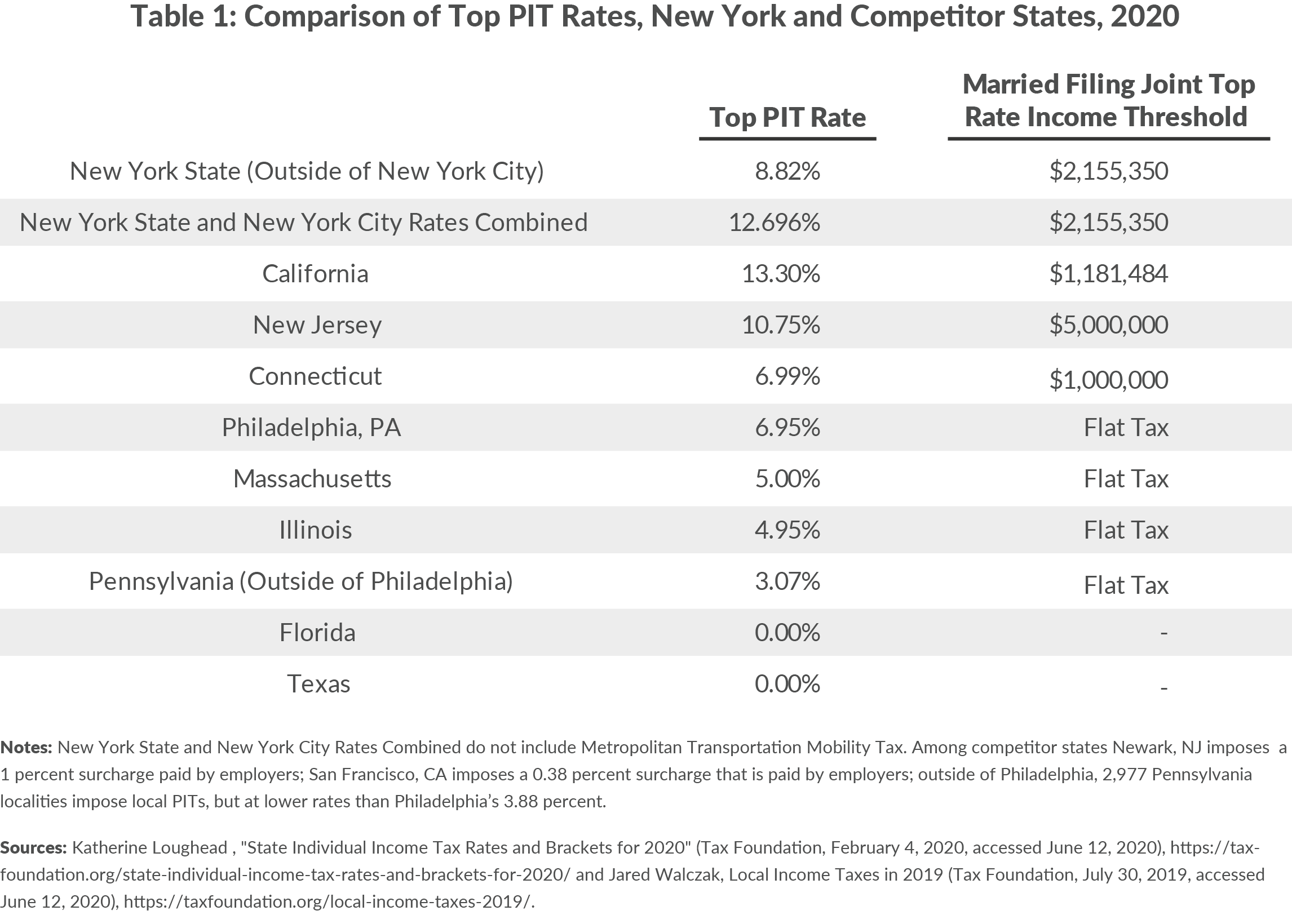

Living in new york city adds more of a strain on your paycheck than living in the rest of the state, as the big apple imposes its own local income tax on top of the state one. If you file a new york state personal income tax return, you must claim this credit directly on your return. If you are not required to file a new york state income tax return, you may still claim this credit. Top state personal income tax rates the following table shows the top marginal tax rate in each state.

New york state currently imposes the 3rd highest rate in the nation. New york city residents must pay an additional tax of up to 3.876% to the city, resulting in a combined top marginal income tax rate of 14.776%, the highest in the nation. View the information on where to find the tax rates and tables for: New york state, new york city, yonkers, and;

The metropolitan commuter transportation mobility tax (mctmt).

Filing your return electronically, when available, is the fastest, safest option. If you live or work in new york city, you'll need to pay income tax. Your new york city tax rate will be 4% to 10.9% for tax year 2022, depending on your filing status and taxable income. Give your refund a boost with the credits you're entitled to!

Explore our most popular credits, below, or see income tax credits for a more comprehensive list. Earned income credit (new york state) (new york city) household credit (new york state) (new york city) New york state income tax rates vary from 4% to 10.9% of individuals’ new york adjusted gross income, depending on your tax bracket and what status you are filing. There are a total of nine income tax brackets in new york state.

If you live in nyc, you are on the hook for both new york state and new york city income taxes.

These changes apply to collections of rent on and after march 1, 2025. All city residents’ income, no matter where it is earned, is subject to new york city personal income tax. Nonresidents of new york city are not liable for new york city personal income tax.