1099-G Colorado Tax Refund: Your Ultimate Guide To Maximizing Your Returns

Ever wondered how the 1099-G form impacts your Colorado tax refund? Well, buckle up, because we're diving deep into the nitty-gritty of this financial puzzle. Whether you're a freelancer, small business owner, or just someone trying to make sense of their taxes, understanding the 1099-G is crucial. This little form holds the key to ensuring you get every penny you deserve back from the state of Colorado. So, let's break it down together!

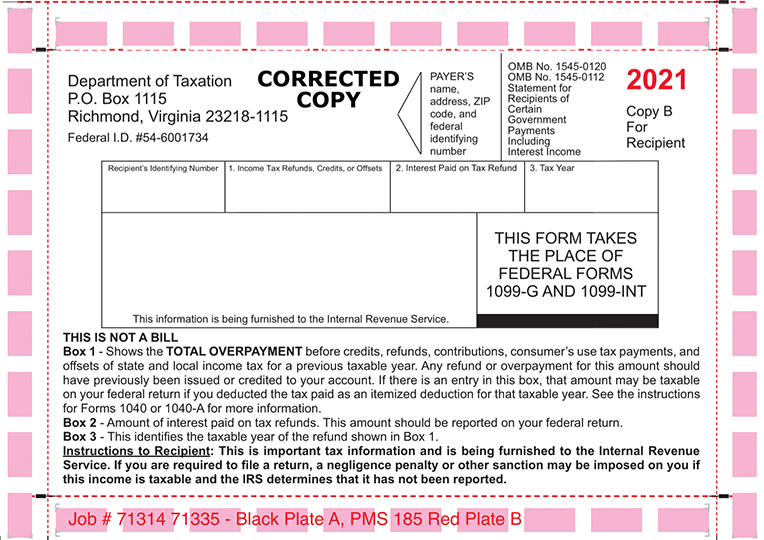

First things first, what exactly is this 1099-G form? Think of it as a report card for your government payments. It’s the form that shows any money you received from federal or state agencies, like unemployment benefits, tax refunds, or other forms of government assistance. For Colorado residents, this form is super important when filing your taxes, especially if you're expecting a refund.

Now, I know taxes can feel like a headache, but trust me, once you get the hang of it, you'll be glad you took the time to understand. This guide isn't just about numbers; it's about empowering you to take control of your financial situation. So, let's roll up our sleeves and figure out how to make the most out of your 1099-G Colorado tax refund!

Read also:Tori Spelling Movies And Tv Shows A Deep Dive Into Her Iconic Career

What is the 1099-G Form All About?

Let's start with the basics. The 1099-G form is essentially a document that reports payments received from government entities. This could include refunds from previous tax filings, unemployment benefits, or any other government-issued payments. If you've ever received money from the state of Colorado, chances are you'll need to file this form during tax season.

This form isn't just for show; it plays a critical role in ensuring your tax return is accurate. Without it, you might end up paying more taxes than you owe—or worse, missing out on a refund you're entitled to. The IRS and state tax authorities use this form to verify your income and ensure everything checks out.

Why Does Colorado Care About the 1099-G?

Colorado, like many states, has its own tax system. When you receive a refund or benefit from the state, it needs to be reported on your federal tax return. The 1099-G form helps bridge the gap between state and federal tax obligations. Think of it as a way for Colorado to keep track of its financial dealings with you.

- It ensures transparency in government payments.

- It helps prevent overpayment or underpayment of taxes.

- It provides a clear record of your financial interactions with the state.

Who Needs to File the 1099-G in Colorado?

Not everyone gets a 1099-G form. If you haven't received any payments from the state of Colorado, you won't need to worry about it. However, if you've received unemployment benefits, a tax refund, or any other form of government assistance, then yes, the 1099-G is for you.

Here's the kicker: even if the amount is small, it still needs to be reported. The IRS doesn't care about the size of the payment; they care about accuracy. Ignoring this form could lead to penalties or audits, and nobody wants that!

Key Scenarios Where You'll Need the 1099-G

Let's break it down further with some real-life examples:

Read also:Sites Like Best Gore Your Ultimate Guide To Dark Content Exploration

- Unemployment Benefits: If you received unemployment compensation during the year, it will be reported on the 1099-G.

- Tax Refunds: Did you get a refund from Colorado last year? That needs to be reported too.

- State Grants: Any grants or subsidies you received from the state will also show up on this form.

How Does the 1099-G Affect Your Colorado Tax Refund?

Here's where things get interesting. The 1099-G form directly impacts your Colorado tax refund. If you received a refund last year, part of it might be taxable this year. Confusing, right? Let me explain.

When you file your taxes, the state may issue you a refund if you overpaid. However, if that refund was due to a deduction or credit, the IRS might consider it taxable income. This is why the 1099-G is so important—it helps you figure out which part of your refund is taxable and which isn't.

Taxable vs. Non-Taxable Portions

Not all refunds are created equal. Some parts of your refund might be completely tax-free, while others could be subject to federal or state taxes. Here's how to tell the difference:

- Taxable Refunds: These are refunds that were issued due to deductions or credits that reduced your tax liability.

- Non-Taxable Refunds: These are refunds that were issued because you overpaid your taxes without using deductions or credits.

Steps to File the 1099-G for Your Colorado Tax Refund

Filing the 1099-G doesn't have to be a nightmare. Follow these simple steps to ensure everything goes smoothly:

- Receive Your Form: The state will send you the 1099-G form by January 31st. If you don't receive it, contact the Colorado Department of Revenue immediately.

- Review the Details: Double-check the amounts listed on the form to make sure they match your records.

- Include It in Your Tax Return: When filing your federal taxes, include the information from the 1099-G form in the appropriate sections.

- Consult a Professional: If you're unsure about anything, don't hesitate to seek help from a tax professional or accountant.

Common Mistakes to Avoid

Here are a few pitfalls to watch out for:

- Forgetting to include the 1099-G form in your tax return.

- Miscalculating the taxable portion of your refund.

- Not reporting unemployment benefits or other government payments.

Maximizing Your Colorado Tax Refund

Now that you understand the 1099-G, let's talk about how to maximize your Colorado tax refund. Here are a few tips to keep in mind:

- Itemize Deductions: If you have a lot of deductions, itemizing can help lower your taxable income.

- Claim Credits: Don't forget about tax credits like the Earned Income Tax Credit (EITC) or Child Tax Credit.

- File Early: The earlier you file, the sooner you'll get your refund.

Using Software to Simplify the Process

Tax software like TurboTax or H&R Block can make filing your taxes a breeze. These programs automatically include the 1099-G form and help you calculate your refund accurately. Plus, they offer guidance every step of the way, so you don't have to stress about missing anything important.

Tax Deadlines and Extensions

Keep an eye on important deadlines. The federal tax deadline is usually April 15th, but it can vary depending on the year. If you need more time, you can request an extension, but remember, this only extends the filing deadline, not the payment deadline.

Penalties for Late Filing

Missing the deadline can result in penalties and interest on any unpaid taxes. To avoid this, file on time or request an extension if necessary. It's always better to be proactive than reactive when it comes to taxes.

Resources and Support

If you're feeling overwhelmed, there are plenty of resources available to help. The IRS website has a wealth of information, and the Colorado Department of Revenue offers assistance for state-specific questions. Don't hesitate to reach out if you need clarification or support.

Hiring a Tax Professional

Sometimes, it's worth investing in a tax professional. They can help you navigate complex tax situations and ensure you're maximizing your refund. Plus, they stay up-to-date with the latest tax laws, so you don't have to.

Conclusion

In summary, the 1099-G form is a vital piece of the tax puzzle, especially for Colorado residents. By understanding how it works and following the steps outlined in this guide, you can ensure you receive every penny you're entitled to. Remember, accuracy is key, so take your time and don't hesitate to seek help if needed.

Now, here's the fun part: share this article with your friends and family who might find it helpful. And if you have any questions or comments, feel free to drop them below. Let's make tax season a little less stressful, one form at a time!

Table of Contents

- What is the 1099-G Form All About?

- Who Needs to File the 1099-G in Colorado?

- How Does the 1099-G Affect Your Colorado Tax Refund?

- Steps to File the 1099-G for Your Colorado Tax Refund

- Maximizing Your Colorado Tax Refund

- Tax Deadlines and Extensions

- Resources and Support