Aagmaal: Your Ultimate Guide To Understanding And Maximizing Wealth

In today's fast-paced world, understanding and maximizing wealth has become a top priority for many individuals seeking financial stability and success. Aagmaal, a comprehensive financial concept, offers a unique approach to managing and growing your wealth. By adopting the principles of Aagmaal, you can enhance your financial literacy and achieve long-term prosperity. This guide will delve into the intricacies of Aagmaal, equipping you with the knowledge and tools to take control of your financial future.

Financial management is no longer just about saving money; it's about strategically investing and utilizing resources to build wealth. Aagmaal provides a holistic framework that addresses various aspects of financial planning, from saving and investing to risk management and wealth distribution. By understanding Aagmaal, you can make informed decisions that align with your financial goals.

Whether you're a beginner looking to improve your financial literacy or an experienced investor seeking advanced strategies, this guide will provide valuable insights into the world of Aagmaal. Let's explore how this concept can transform your approach to wealth management and empower you to achieve financial independence.

Read also:Www Kannada Movierulz 2024 Your Ultimate Guide To Kannada Movies

What is Aagmaal: An Overview

Aagmaal refers to a comprehensive financial philosophy that emphasizes the importance of understanding and maximizing wealth through strategic planning and execution. It is not merely about accumulating money but also about creating sustainable wealth that benefits both the individual and society. The concept of Aagmaal is deeply rooted in principles that encourage ethical financial practices and responsible wealth management.

This section will explore the foundational elements of Aagmaal, including its origins, core principles, and how it differs from traditional financial management approaches. By gaining a deeper understanding of Aagmaal, you can begin to incorporate its principles into your financial strategy.

Origins of Aagmaal

The concept of Aagmaal has its roots in ancient financial philosophies that emphasize the importance of ethical wealth management. Over time, these principles have evolved to address the complexities of modern financial systems while maintaining their core values. The origins of Aagmaal can be traced back to traditional practices that prioritize long-term financial health over short-term gains.

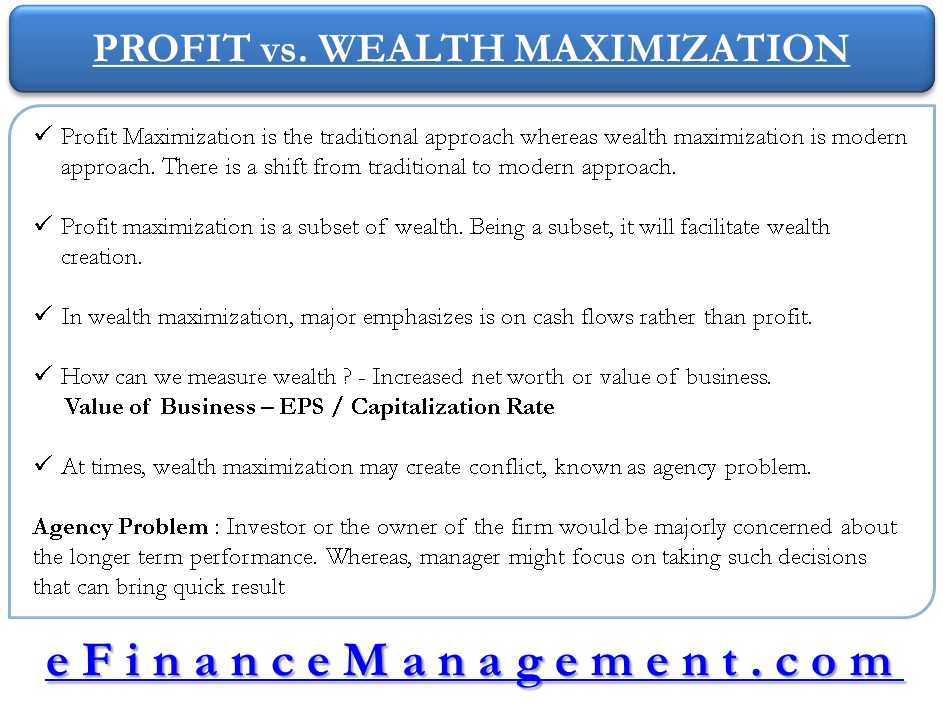

Core Principles of Aagmaal

- Strategic Financial Planning: Aagmaal encourages individuals to create a comprehensive financial plan that aligns with their long-term goals.

- Ethical Wealth Management: This principle emphasizes the importance of managing wealth responsibly and ethically, ensuring that financial decisions benefit both the individual and society.

- Risk Management: Aagmaal advocates for a proactive approach to risk management, helping individuals identify and mitigate potential financial risks.

- Wealth Distribution: The concept also emphasizes the importance of distributing wealth fairly, ensuring that financial resources are used to benefit all stakeholders.

Why Aagmaal is Essential for Wealth Management

In today's complex financial landscape, understanding Aagmaal is crucial for anyone looking to maximize their wealth. By adopting the principles of Aagmaal, individuals can develop a more comprehensive approach to financial management that addresses various aspects of wealth creation and preservation.

This section will delve into the reasons why Aagmaal is essential for effective wealth management, highlighting its benefits and how it can help you achieve your financial goals.

Benefits of Aagmaal in Wealth Management

- Enhanced Financial Literacy: Aagmaal equips individuals with the knowledge and tools needed to make informed financial decisions.

- Increased Wealth Potential: By following the principles of Aagmaal, individuals can unlock new opportunities for wealth creation and growth.

- Improved Risk Management: Aagmaal's focus on proactive risk management helps individuals protect their financial assets from potential threats.

Understanding the Components of Aagmaal

Aagmaal comprises several key components that work together to create a comprehensive financial management system. These components include saving, investing, risk management, and wealth distribution. By understanding each component and how they interact, you can develop a more effective financial strategy that maximizes your wealth potential.

Read also:Layla Jenner Career A Comprehensive Guide To Her Journey And Success

Saving: The Foundation of Aagmaal

Saving is a fundamental aspect of Aagmaal, providing the financial foundation necessary for wealth creation and preservation. Effective saving strategies involve setting clear financial goals, creating a budget, and consistently setting aside a portion of your income for future use.

Investing: Growing Your Wealth

Investing is another critical component of Aagmaal, allowing individuals to grow their wealth by allocating resources to various investment vehicles. By diversifying your investment portfolio, you can minimize risk while maximizing potential returns.

Risk Management: Protecting Your Wealth

Risk management is an essential component of Aagmaal, helping individuals identify and mitigate potential financial risks. By implementing effective risk management strategies, you can protect your financial assets and ensure long-term stability.

Wealth Distribution: Sharing Your Wealth

Wealth distribution is a vital aspect of Aagmaal, emphasizing the importance of using financial resources to benefit both the individual and society. By distributing wealth fairly, you can create a positive impact on your community and contribute to the greater good.

Implementing Aagmaal in Your Financial Strategy

Now that you understand the components of Aagmaal, it's time to incorporate these principles into your financial strategy. This section will provide practical guidance on how to implement Aagmaal in your financial planning, helping you achieve your wealth management goals.

Creating a Comprehensive Financial Plan

To implement Aagmaal effectively, you must create a comprehensive financial plan that incorporates all its components. Begin by setting clear financial goals, assessing your current financial situation, and identifying areas for improvement. Then, develop a detailed plan that outlines specific actions you will take to achieve your goals.

Building an Investment Portfolio

A key aspect of implementing Aagmaal is building a diversified investment portfolio that aligns with your financial goals. Consider various investment options, such as stocks, bonds, real estate, and mutual funds, to create a balanced portfolio that maximizes potential returns while minimizing risk.

Managing Financial Risks

Effective risk management is crucial for successful Aagmaal implementation. Identify potential financial risks and develop strategies to mitigate them, such as purchasing insurance, maintaining an emergency fund, and regularly reviewing your financial plan.

Distributing Wealth Ethically

As part of your Aagmaal implementation, consider how you can distribute your wealth ethically and responsibly. Explore opportunities to give back to your community, such as supporting charitable organizations or participating in volunteer activities.

Maximizing Wealth with Aagmaal

With a solid understanding of Aagmaal and its components, you can now focus on maximizing your wealth. This section will provide advanced strategies for leveraging Aagmaal principles to achieve financial success.

Advanced Saving Strategies

To maximize your wealth, consider implementing advanced saving strategies that go beyond traditional methods. Explore options such as high-yield savings accounts, certificates of deposit, and retirement accounts to optimize your savings potential.

Optimizing Investment Returns

Maximizing wealth also involves optimizing your investment returns. Research various investment strategies, such as dollar-cost averaging, value investing, and growth investing, to identify the best approach for your financial goals.

Enhancing Risk Management Techniques

Effective risk management is essential for maximizing wealth. Enhance your risk management techniques by regularly reviewing your financial plan, diversifying your investment portfolio, and staying informed about market trends and economic conditions.

Fair Wealth Distribution Practices

To maximize the impact of your wealth, adopt fair wealth distribution practices that benefit both you and your community. Consider establishing a charitable foundation, creating a legacy plan, or participating in community development projects.

Common Challenges in Aagmaal Implementation

While implementing Aagmaal can lead to significant financial success, it is not without its challenges. This section will address common obstacles individuals may face when adopting Aagmaal principles and provide solutions to overcome them.

Overcoming Financial Literacy Barriers

One of the most significant challenges in Aagmaal implementation is overcoming financial literacy barriers. To address this issue, invest time in educating yourself about financial concepts and strategies, and consider seeking guidance from a financial advisor.

Managing Financial Risks Effectively

Effectively managing financial risks is another challenge in Aagmaal implementation. Develop a proactive risk management strategy that includes regular financial assessments, contingency planning, and insurance coverage.

Ensuring Ethical Wealth Distribution

Implementing ethical wealth distribution practices can be challenging, especially when balancing personal and societal needs. To overcome this challenge, establish clear guidelines for wealth distribution and regularly review your approach to ensure it aligns with your values and goals.

Conclusion and Call to Action

Aagmaal offers a comprehensive approach to understanding and maximizing wealth, providing individuals with the knowledge and tools needed to achieve financial success. By incorporating Aagmaal principles into your financial strategy, you can create a more effective and sustainable approach to wealth management.

To take the next step in your financial journey, consider implementing the strategies outlined in this guide and exploring additional resources to enhance your understanding of Aagmaal. Don't forget to share your thoughts and experiences in the comments section below and explore other articles on our site for more valuable insights into the world of finance.

Table of Contents

- What is Aagmaal: An Overview

- Why Aagmaal is Essential for Wealth Management

- Understanding the Components of Aagmaal

- Implementing Aagmaal in Your Financial Strategy

- Maximizing Wealth with Aagmaal

- Common Challenges in Aagmaal Implementation

- Conclusion and Call to Action

Subheadings

- Origins of Aagmaal

- Core Principles of Aagmaal

- Benefits of Aagmaal in Wealth Management

- Saving: The Foundation of Aagmaal

- Investing: Growing Your Wealth

- Risk Management: Protecting Your Wealth

- Wealth Distribution: Sharing Your Wealth