5starsstocks.com Best Stocks: Your Ultimate Guide To Unlocking Profitable Investment Opportunities

Are you ready to dive into the world of stock investing and discover the best stocks that can boost your portfolio? If you've stumbled upon 5starsstocks.com, you're in the right place! This platform has become a go-to resource for investors looking to identify top-performing stocks. Whether you're a seasoned trader or just starting out, understanding how to pick the best stocks is crucial for building wealth over time.

Investing in stocks can feel overwhelming at first, but with the right guidance, it becomes an exciting journey. 5starsstocks.com has made a name for itself by offering reliable insights into the stock market. Their team of analysts works tirelessly to analyze trends and provide actionable recommendations. But before we dive deep into the specifics, let's talk about why choosing the best stocks matters and how this platform can help you achieve your financial goals.

In today's fast-paced world, having a solid investment strategy is more important than ever. With inflation rising and economic uncertainties looming, finding stocks that deliver consistent returns is key to securing your financial future. This article will break down everything you need to know about 5starsstocks.com and how it can assist you in identifying the best stocks for your portfolio. Let's get started!

Read also:Nfl 2024 Mock Draft Simulator Your Ultimate Guide To Predicting The Next Big Stars

Table of Contents

- What is 5starsstocks.com?

- Why Are Best Stocks Important?

- How to Identify the Best Stocks

- 5starsstocks.com's Stock Selection Strategy

- Top Stocks to Watch in 2023

- Risk Management in Stock Investing

- Long-Term vs Short-Term Investing

- Tools and Resources for Stock Investors

- Common Mistakes to Avoid in Stock Investing

- Conclusion: Take Control of Your Financial Future

What is 5starsstocks.com?

5starsstocks.com is not just another stock analysis website; it's a powerhouse of information designed to help investors make smarter decisions. The platform offers comprehensive reports, real-time market updates, and expert analysis to guide you through the complexities of the stock market. It's like having a personal stock advisor at your fingertips, but with a lot more data and insights.

One of the standout features of 5starsstocks.com is its focus on transparency. They don't just tell you which stocks to buy; they explain why these stocks are worth considering. Their team dives deep into company financials, industry trends, and macroeconomic factors to provide a holistic view of each stock recommendation. This approach ensures that investors can make informed decisions rather than relying on guesswork.

Key Features of 5starsstocks.com

- Real-time stock performance tracking

- Detailed company financial analysis

- Expert insights from seasoned analysts

- User-friendly interface for easy navigation

- Regular updates on market trends and news

Why Are Best Stocks Important?

Picking the right stocks can make all the difference in your investment journey. Imagine this: two investors start with the same amount of money, but one chooses high-performing stocks while the other picks underperforming ones. Guess who ends up with a larger portfolio? Yep, it's the one who invested in the best stocks. But what exactly makes a stock "the best"?

Best stocks are those that consistently outperform the market, deliver strong returns, and have a solid growth potential. They are backed by companies with strong fundamentals, innovative business models, and a clear path to profitability. When you invest in these stocks, you're essentially betting on the future success of the companies behind them. And let's face it, who doesn't want to be part of the next big thing?

Characteristics of Best Stocks

- Strong financial health with increasing revenue and profit margins

- Innovative products or services that address real-world problems

- Competitive advantage in their respective industries

- Positive market sentiment and analyst ratings

- Consistent dividend payments (for income-focused investors)

How to Identify the Best Stocks

Identifying the best stocks requires a combination of research, analysis, and a bit of intuition. While there's no foolproof formula, following a structured approach can significantly improve your chances of success. Here are some steps to help you find the best stocks for your portfolio:

Read also:Big Easy Cary The Hidden Gem Of North Carolina Thats Got Everyone Talking

Start by looking at the company's financial statements. Pay attention to metrics like revenue growth, earnings per share (EPS), and debt levels. A company with strong financials is more likely to weather economic downturns and deliver long-term value. Next, analyze the industry landscape. Is the company operating in a growing sector? Does it have a competitive edge over its rivals? These factors can give you insights into the stock's potential.

Tools for Stock Analysis

- 5starsstocks.com's stock screener

- Yahoo Finance for detailed financial data

- Seeking Alpha for expert opinions and analysis

- Google Trends to gauge market sentiment

5starsstocks.com's Stock Selection Strategy

At the heart of 5starsstocks.com's success lies its robust stock selection strategy. The platform uses a combination of quantitative and qualitative analysis to identify the best stocks. Their team employs advanced algorithms to crunch numbers and identify trends that might not be immediately obvious. But they don't stop there; they also consider qualitative factors like management quality, brand reputation, and customer satisfaction.

One of the key aspects of their strategy is diversification. They recommend building a portfolio that includes stocks from different sectors and industries. This approach helps mitigate risk and ensures that your investments are not overly reliant on the performance of a single stock or sector. Additionally, they emphasize the importance of staying informed about global economic trends, as these can have a significant impact on stock prices.

Steps in 5starsstocks.com's Strategy

- Screen stocks based on financial metrics

- Analyze industry trends and competitive landscape

- Assess management quality and corporate governance

- Monitor macroeconomic factors and global events

Top Stocks to Watch in 2023

As we move deeper into 2023, several stocks have emerged as top contenders for investors. These companies are leading the charge in their respective industries, driven by innovation, strong leadership, and a commitment to sustainability. While past performance is not indicative of future results, these stocks have shown remarkable resilience and growth potential.

Some of the top stocks to watch in 2023 include tech giants like Apple and Microsoft, as well as emerging players in renewable energy and artificial intelligence. These sectors are expected to see significant growth over the next few years, driven by increasing demand for sustainable solutions and cutting-edge technology.

Industries to Focus On

- Technology and software development

- Renewable energy and clean tech

- Healthcare and biotechnology

- Consumer goods and e-commerce

Risk Management in Stock Investing

Investing in stocks comes with inherent risks, but with proper risk management, you can minimize potential losses. One of the most effective strategies is diversification, which we've already discussed. By spreading your investments across different asset classes, you reduce the impact of any single stock's poor performance on your overall portfolio.

Another important aspect of risk management is setting clear investment goals and sticking to them. Whether you're investing for retirement, buying a house, or funding your children's education, having a well-defined objective can help you stay focused and avoid making impulsive decisions based on market fluctuations.

Best Practices for Risk Management

- Diversify your portfolio across sectors and geographies

- Set stop-loss orders to limit potential losses

- Rebalance your portfolio periodically to maintain your desired asset allocation

- Stay informed about market trends and economic indicators

Long-Term vs Short-Term Investing

When it comes to stock investing, one of the biggest decisions you'll face is whether to focus on long-term or short-term gains. Both approaches have their pros and cons, and the best choice depends on your financial goals and risk tolerance.

Long-term investing involves holding stocks for an extended period, usually several years or more. This approach allows you to benefit from compounding returns and ride out short-term market volatility. It's ideal for investors who are in it for the long haul and are not easily swayed by daily price fluctuations.

On the other hand, short-term investing focuses on quick gains by taking advantage of market inefficiencies or temporary price discrepancies. While it can be lucrative, it also carries higher risks and requires a more hands-on approach. Short-term investors need to stay on top of market news and trends to make timely decisions.

Which Approach is Right for You?

- Long-term investing: Ideal for retirement planning and wealth building

- Short-term investing: Suitable for those seeking quick profits and willing to take on more risk

Tools and Resources for Stock Investors

Investing in stocks doesn't have to be a solo endeavor. There are plenty of tools and resources available to help you make informed decisions. From stock screeners to financial news websites, these resources can provide valuable insights and data to support your investment strategy.

5starsstocks.com is just one of the many platforms you can use to enhance your stock investing journey. Others, like Morningstar, Bloomberg, and CNBC, offer a wealth of information on market trends, company performance, and economic indicators. By leveraging these resources, you can stay ahead of the curve and make smarter investment choices.

Top Tools for Stock Investors

- 5starsstocks.com for stock analysis and recommendations

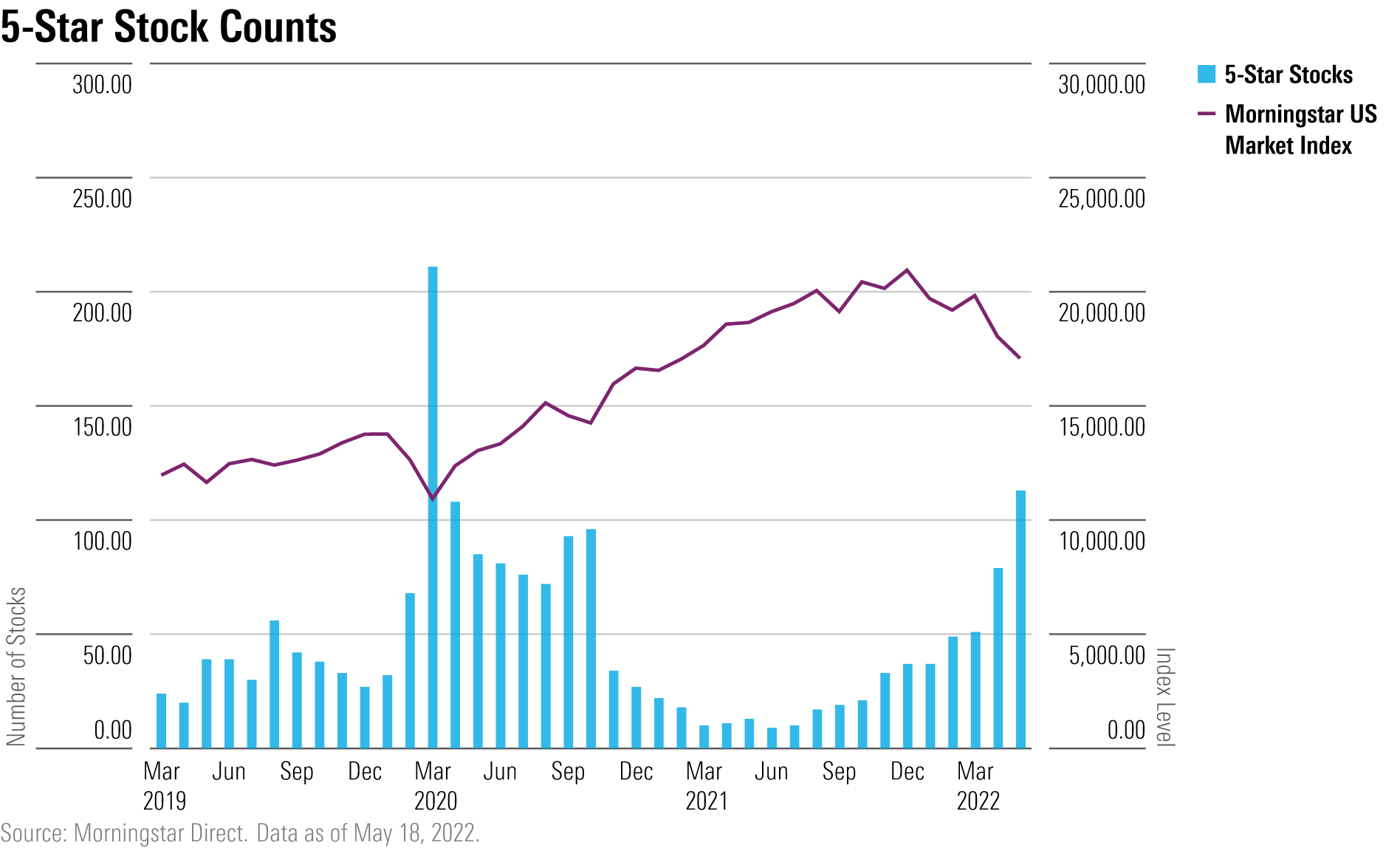

- Morningstar for in-depth company research

- Bloomberg for real-time market news and data

- TradingView for technical analysis and charting

Common Mistakes to Avoid in Stock Investing

Even the most experienced investors make mistakes from time to time. The key is to learn from them and adjust your strategy accordingly. Some common mistakes to avoid include emotional decision-making, chasing hot stocks without proper research, and neglecting diversification.

Another pitfall to watch out for is overtrading. Constantly buying and selling stocks can lead to high transaction costs and tax liabilities, eroding your potential returns. Instead, focus on building a well-balanced portfolio and sticking to your long-term investment plan.

How to Avoid Common Mistakes

- Do thorough research before making any investment

- Avoid making impulsive decisions based on emotions or market hype

- Regularly review and rebalance your portfolio

- Stay disciplined and stick to your investment strategy

Conclusion: Take Control of Your Financial Future

Investing in stocks can be a rewarding way to grow your wealth, but it requires knowledge, discipline, and a well-thought-out strategy. Platforms like 5starsstocks.com provide valuable insights and tools to help you navigate the stock market and identify the best stocks for your portfolio. By following the tips and strategies outlined in this article, you can increase your chances of success and achieve your financial goals.

So, what are you waiting for? Take control of your financial future by educating yourself and making informed investment decisions. And don't forget to share this article with your friends and family who might benefit from the information. Together, we can all become smarter investors and build a brighter financial future!