Mastering PNC ATM Withdrawal Limit: A Comprehensive Guide For Savvy Bankers

Imagine this: you're at the ATM, ready to withdraw some cash, but suddenly, your transaction gets denied. Frustrating, right? If you're a PNC Bank customer, understanding your PNC ATM withdrawal limit is crucial to avoid such headaches. Whether you're planning a big purchase or just need some extra cash, knowing your limits can save you from unnecessary stress. So, buckle up, because we're diving deep into the world of PNC ATM withdrawal limits and giving you all the insider tips you need.

Now, you might be wondering why banks impose these limits in the first place. Well, it's all about protecting your account from unauthorized transactions and ensuring your financial safety. But don't worry, we're here to break it down for you in simple terms. This guide will walk you through everything you need to know about PNC ATM withdrawal limits, including how to increase them and what to do if you hit your cap.

By the time you finish reading this, you'll have a solid understanding of how PNC ATM withdrawal limits work, how they affect your daily transactions, and how to manage them effectively. So, whether you're a long-time PNC customer or just considering opening an account, this article is your ultimate resource.

Read also:Houston Chronicle Obituary A Comprehensive Guide To Celebrating Lives

Understanding the Basics of PNC ATM Withdrawal Limit

Let's start with the basics. What exactly is a PNC ATM withdrawal limit? Simply put, it's the maximum amount of money you can withdraw from an ATM in a single day. This limit is set by PNC Bank to protect your account and prevent fraudulent activities. But here's the thing—different accounts may have different limits, so it's important to know where you stand.

Why Do Banks Impose Withdrawal Limits?

Now, you might be thinking, "Why do banks even bother with these limits?" Well, there are a few good reasons. First and foremost, withdrawal limits help prevent fraud. If someone gains unauthorized access to your account, they won't be able to drain it completely in one go. Plus, these limits encourage responsible spending and help you keep track of your finances.

Types of PNC ATM Withdrawal Limits

Not all PNC ATM withdrawal limits are created equal. Depending on your account type and preferences, you might have different limits. Let's break it down:

Standard Withdrawal Limits

For most PNC Bank customers, the standard ATM withdrawal limit is around $500 per day. This applies to both PNC-branded ATMs and non-PNC ATMs. However, keep in mind that using non-PNC ATMs might incur additional fees, so it's always better to stick with PNC machines whenever possible.

Premium Account Limits

Now, if you're lucky enough to have a premium account, like a Performance or Premier account, your limits might be a bit higher. These accounts often come with perks like increased withdrawal limits, fee waivers, and other exclusive benefits. So, if you're a frequent ATM user, upgrading to a premium account might be worth considering.

Factors Affecting Your PNC ATM Withdrawal Limit

Several factors can influence your PNC ATM withdrawal limit. Here are a few things to keep in mind:

Read also:Publix Bogos This Week Your Ultimate Guide To Savings

- Account Type: As mentioned earlier, different accounts may have different limits. Premium accounts typically offer higher limits than standard accounts.

- Transaction History: If you have a history of large transactions, PNC might adjust your limits accordingly. This is all part of their effort to ensure your account remains secure.

- Location: Believe it or not, your location can also play a role. For example, if you're traveling abroad, your withdrawal limits might be temporarily reduced to prevent fraud.

How to Check Your PNC ATM Withdrawal Limit

So, how do you find out what your specific withdrawal limit is? It's actually pretty easy. Here are a few ways to check:

Online Banking

Head over to the PNC Bank website and log in to your account. Once you're in, navigate to the "Account Details" section, where you should find information about your withdrawal limits. If you can't locate it, don't hesitate to reach out to PNC customer support for clarification.

Mobile App

Alternatively, you can use the PNC Mobile App to check your limits. Simply log in, go to your account summary, and look for the section on withdrawal limits. The app also allows you to monitor your transactions in real-time, so you'll always know how much you've withdrawn.

Customer Service

Still unsure? Give PNC customer service a call. They'll be happy to provide you with all the details about your withdrawal limits and answer any questions you might have. Plus, speaking directly to a representative can often give you more personalized advice.

Increasing Your PNC ATM Withdrawal Limit

What if $500 just isn't enough for your needs? Don't worry, you can request an increase in your PNC ATM withdrawal limit. Here's how:

Requesting a Temporary Increase

For one-time needs, like a big purchase or a special event, you can request a temporary increase in your withdrawal limit. Simply contact PNC customer service and explain your situation. They'll review your account and, if everything checks out, they might grant you a temporary boost.

Permanent Limit Increase

If you find yourself consistently needing more cash, you can apply for a permanent limit increase. This usually involves providing documentation of your financial stability, such as pay stubs or bank statements. Keep in mind that PNC will review your account activity before making a decision, so it's important to maintain a healthy financial history.

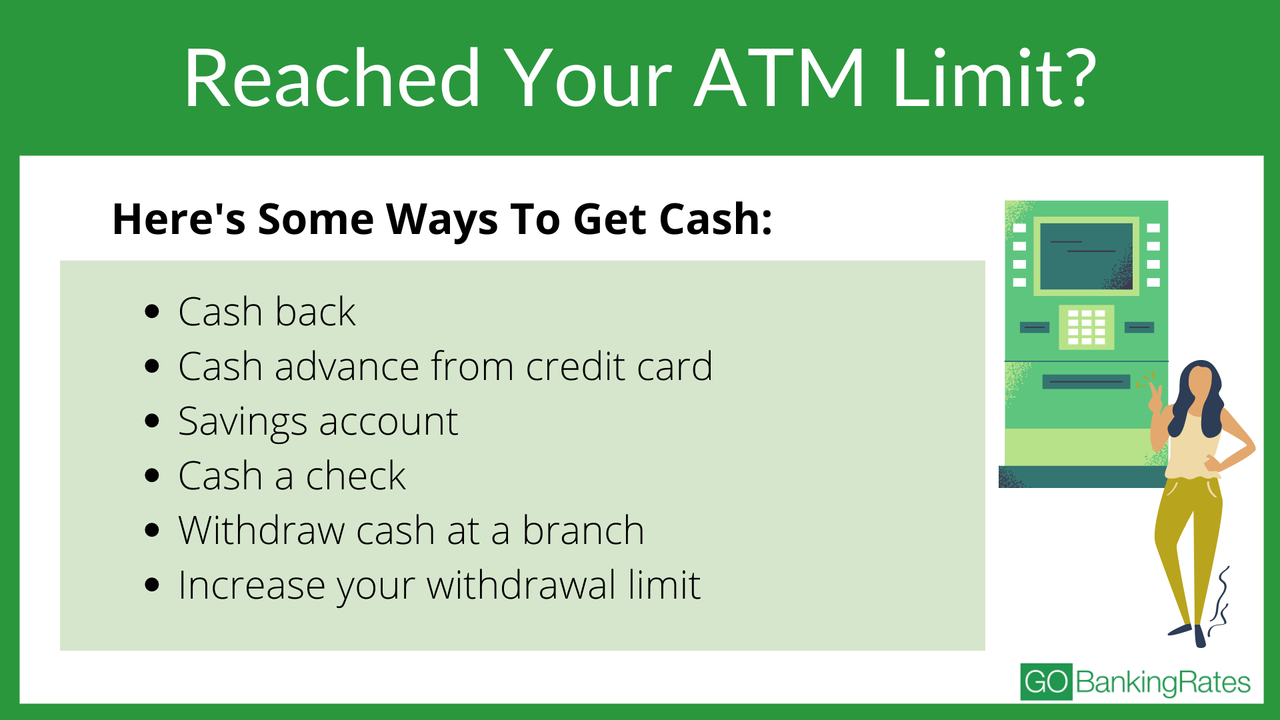

What Happens If You Hit Your PNC ATM Withdrawal Limit?

So, what happens if you hit your daily withdrawal limit? Don't panic—there are a few options you can explore:

- Wait Until the Next Day: The simplest solution is to wait until the next day when your limit resets. This gives you time to plan your withdrawals more effectively.

- Visit a Branch: If you need cash urgently, you can always visit a PNC branch and withdraw additional funds in person. Just be prepared to show ID and explain your situation.

- Transfer Funds: Another option is to transfer funds from your account to another account or card that doesn't have the same withdrawal limits. This can be a quick fix if you're in a bind.

Tips for Managing Your PNC ATM Withdrawal Limit

Now that you know all about PNC ATM withdrawal limits, here are a few tips to help you manage them effectively:

Plan Your Withdrawals

Instead of making multiple small withdrawals throughout the week, try to plan larger withdrawals less frequently. This not only helps you stay within your limit but also reduces the number of ATM fees you might incur.

Monitor Your Transactions

Regularly checking your account activity can help you stay on top of your withdrawals and avoid hitting your limit unexpectedly. Use the PNC Mobile App to get real-time updates on your transactions.

Consider Alternatives

If you find yourself constantly hitting your withdrawal limit, it might be worth exploring alternative banking options. Some accounts offer higher limits or even unlimited withdrawals, so it pays to do your research.

Common Questions About PNC ATM Withdrawal Limits

Let's address some frequently asked questions about PNC ATM withdrawal limits:

Can I Withdraw More Than My Daily Limit?

Not through an ATM, no. However, you can visit a PNC branch or transfer funds to another account to access additional cash. Always remember to plan ahead to avoid hitting your limit unexpectedly.

Do Non-PNC ATMs Have Different Limits?

No, the withdrawal limits remain the same whether you use a PNC ATM or a non-PNC ATM. However, using non-PNC ATMs may result in additional fees, so it's always best to stick with PNC machines whenever possible.

Conclusion: Master Your PNC ATM Withdrawal Limit

And there you have it—everything you need to know about PNC ATM withdrawal limits. By understanding how these limits work and how to manage them effectively, you can avoid unnecessary stress and ensure smooth financial transactions. Remember, if you ever need to increase your limit or have questions about your account, don't hesitate to reach out to PNC customer service.

So, what are you waiting for? Take control of your finances and make the most out of your PNC Bank account. And if you found this article helpful, be sure to share it with your friends and family. Together, we can all become smarter, more informed bankers!

References

This guide is based on official information from PNC Bank and industry best practices. For more detailed information, visit the PNC Bank website or consult with a financial advisor.

Table of Contents

- Understanding the Basics of PNC ATM Withdrawal Limit

- Types of PNC ATM Withdrawal Limits

- Factors Affecting Your PNC ATM Withdrawal Limit

- How to Check Your PNC ATM Withdrawal Limit

- Increasing Your PNC ATM Withdrawal Limit

- What Happens If You Hit Your PNC ATM Withdrawal Limit?

- Tips for Managing Your PNC ATM Withdrawal Limit

- Common Questions About PNC ATM Withdrawal Limits

- Conclusion: Master Your PNC ATM Withdrawal Limit

- References

![PNC ATM withdrawal limits [2024] Wise](https://wise.com/imaginary-v2/27ebf733d73da98aca88b6ed90c0d8f6.jpg?width=1200)

![PNC ATM Withdrawal Limit [2025 Guide]](https://nearbyatms.com/wp-content/uploads/2024/04/atm.png)