Why Marshalls Credit Card Could Be Your Next Shopping Game-Changer

Listen up, folks. If you're a fan of scoring killer deals while also earning sweet rewards, the Marshalls Credit Card might just be your new best friend. Yep, you heard me right. This card is designed to give you the ultimate shopping experience while keeping your wallet happy. So, before we dive deep into the nitty-gritty, let's talk about why this card deserves your attention.

Shopping at Marshalls can already feel like a treasure hunt, but adding their credit card into the mix? That's like finding the treasure map. Whether you're after trendy clothes, home goods, or accessories, this card could level up your shopping game. Stick around, and I'll break down everything you need to know.

Now, don't get me wrong. Not every credit card is created equal, and you gotta weigh the pros and cons. But if you're someone who frequents Marshalls or loves a good bargain, this card might be worth considering. Let's explore what makes it tick and how it can benefit your shopping adventures.

Read also:Butt Chins The Curious Trend Thats Taking Over Social Media

Understanding Marshalls Credit Card: A Quick Overview

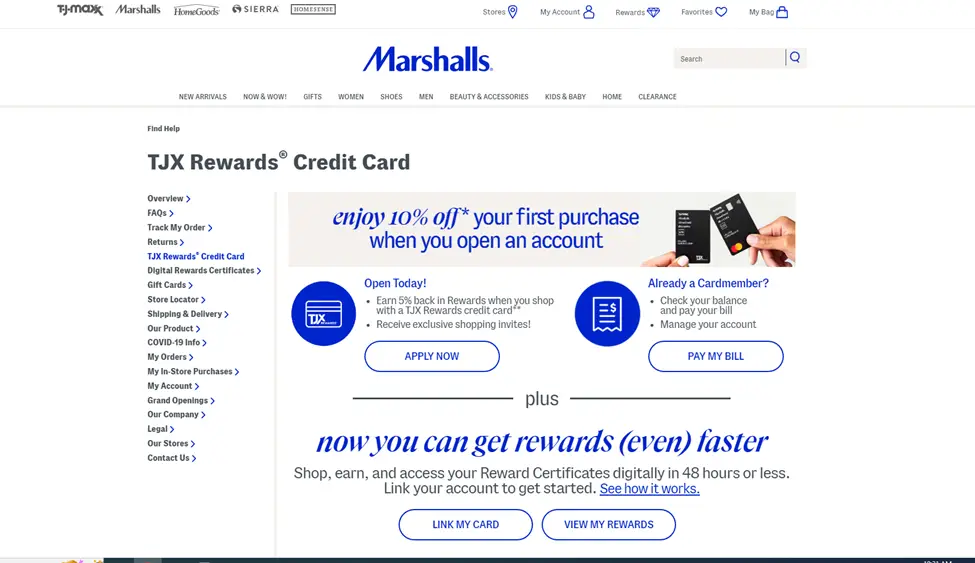

First things first, what exactly is the Marshalls Credit Card? Well, it's a co-branded credit card offered by Marshalls in partnership with Synchrony Bank. This card is designed to reward loyal customers who shop at Marshalls, as well as its sister stores like HomeGoods and T.J. Maxx. It's not just any card; it's a tool to enhance your shopping experience.

Here's the deal: this card offers exclusive perks, discounts, and rewards that you won't find with regular credit cards. Plus, it's tailored to fit the lifestyle of savvy shoppers who want to save money while enjoying the things they love. So, let's dig deeper into what makes this card stand out.

Key Benefits of Marshalls Credit Card

Alright, let's get to the good stuff. What benefits can you expect from the Marshalls Credit Card? Here's a quick rundown:

- Exclusive Discounts: Cardholders get access to special savings and promotions that aren't available to regular shoppers.

- No Annual Fee: Yep, you read that right. This card doesn't come with an annual fee, so you can enjoy the perks without worrying about extra charges.

- Interest-Free Periods: For a limited time, you can enjoy interest-free periods on purchases, which is a huge plus if you're making big-ticket buys.

- Rewards Program: Earn points on your purchases that can be redeemed for discounts on future shopping trips.

These benefits are just the tip of the iceberg. Keep reading, and I'll break down each one in more detail.

How Marshalls Credit Card Works

So, how does this card actually work? It's pretty straightforward. Once you apply and get approved, you'll receive your card in the mail. From there, you can start using it at Marshalls, HomeGoods, and T.J. Maxx. Every time you swipe your card, you'll earn rewards points that can be redeemed for discounts on future purchases.

Plus, you'll have access to exclusive sales and promotions that aren't available to non-cardholders. It's like getting a backstage pass to the best deals in town. But remember, it's important to manage your spending wisely and pay off your balance on time to avoid interest charges.

Read also:How To Easily Access And Understand Your Patientlabcorpresults

Eligibility and Application Process

Now, let's talk about who can apply and how to get started. To be eligible for the Marshalls Credit Card, you'll need to meet a few basic requirements:

- Be at least 18 years old (or 21 in some states).

- Have a valid Social Security number or Individual Taxpayer Identification Number.

- Provide proof of income during the application process.

Applying is easy. You can do it online or in-store. Just fill out the application form, and you'll get an instant decision in most cases. If approved, your card will be on its way to you in no time.

Marshalls Credit Card Rewards Program

Let's talk about the rewards program, because this is where things get really exciting. With the Marshalls Credit Card, you can earn points on every purchase you make. These points can be redeemed for discounts on future shopping trips, so you're essentially getting paid to shop.

Here's how it works:

- Earn 1 point for every dollar spent at Marshalls, HomeGoods, and T.J. Maxx.

- Earn 1 point for every $2 spent at other retailers.

- Redeem your points for discounts on future purchases. For example, 1,000 points = $10 off.

It's a simple and effective way to save money on the things you love. And the more you shop, the more you save. What's not to love?

Maximizing Your Rewards

Now that you know how the rewards program works, let's talk about how to maximize your points. Here are a few tips:

- Use your Marshalls Credit Card for all your shopping needs, not just at Marshalls. Every dollar counts.

- Keep an eye out for bonus point promotions. Sometimes, you can earn double or triple points on certain purchases.

- Redeem your points regularly to avoid losing them. Points don't last forever, so it's best to use them while they're still active.

By following these tips, you can make the most of your rewards and save even more money.

Marshalls Credit Card Fees and Interest Rates

Let's get real for a moment. While the Marshalls Credit Card offers plenty of benefits, it's important to understand the fees and interest rates. Here's what you need to know:

- No Annual Fee: As mentioned earlier, this card doesn't come with an annual fee, which is a huge plus.

- Variable APR: The interest rate on purchases varies, but it's typically competitive with other retail credit cards.

- Late Payment Fee: If you miss a payment, you'll be hit with a late fee, so it's important to pay your bill on time.

Remember, the key to avoiding interest charges is to pay off your balance in full each month. If you carry a balance, you'll be charged interest, which can add up quickly.

Managing Your Account

Managing your Marshalls Credit Card account is easy. You can do it all online or through the mobile app. Here's what you can do:

- View your account balance and transaction history.

- Make payments and set up automatic payments to avoid late fees.

- Track your rewards points and redeem them for discounts.

Having access to your account at your fingertips makes it easy to stay on top of your finances and maximize your rewards.

Is Marshalls Credit Card Right for You?

Now that we've covered the basics, let's talk about whether the Marshalls Credit Card is the right choice for you. Here are a few questions to consider:

- Do you shop frequently at Marshalls, HomeGoods, or T.J. Maxx?

- Are you comfortable managing a credit card responsibly?

- Do you want to earn rewards and save money on your purchases?

If you answered yes to these questions, then the Marshalls Credit Card could be a great fit for you. But if you're not a regular shopper at these stores, you might want to explore other credit card options that align better with your spending habits.

Alternatives to Consider

Of course, the Marshalls Credit Card isn't the only option out there. Here are a few alternatives to consider:

- Other Retail Credit Cards: If you shop at other stores, you might want to explore their credit card offerings.

- Cash Back Credit Cards: These cards offer cash back on purchases, which can be redeemed for statement credits or cash.

- Travel Rewards Credit Cards: If you're a frequent traveler, these cards can offer valuable rewards for flights and hotels.

It's all about finding the card that fits your lifestyle and financial goals.

Final Thoughts and Recommendations

So, there you have it. The Marshalls Credit Card is a solid option for anyone who loves shopping at Marshalls, HomeGoods, or T.J. Maxx. With its exclusive benefits, rewards program, and no annual fee, it's a great way to save money while enjoying the things you love.

But remember, responsible credit card usage is key. Pay your bill on time, avoid carrying a balance, and use your card wisely. If you do that, you'll be on your way to reaping the rewards and making the most of your shopping experience.

So, what are you waiting for? Head over to Marshalls and apply for your card today. And don't forget to share your thoughts in the comments below. Let me know if you've had any experiences with the Marshalls Credit Card or if you have any questions. Happy shopping, folks!

Table of Contents

Understanding Marshalls Credit Card: A Quick Overview

Key Benefits of Marshalls Credit Card

How Marshalls Credit Card Works

Eligibility and Application Process

Marshalls Credit Card Rewards Program

Marshalls Credit Card Fees and Interest Rates

Is Marshalls Credit Card Right for You?

Final Thoughts and Recommendations

That's all for now, folks. Keep those credit cards in check and keep those deals rolling in!